Understanding context to empower entrepreneurs to make more sales

CUSTOMER RESEARCH

Disclaimer: The views and opinions expressed in this study are those of the authors and do not necessarily reflect the views of the organisation or its members.

Many small businesses in South Africa have started using mobile payments to complete sales.

These businesses are often using technology and accepting card payments for the first time. With an influx of new businesses using these products, the needs of the user base were changing.

We needed to understand the context, behaviours and values of this growing base, so that we could more effectively support these businesses in making more sales.

Problem

For a small business, sales are worth more than the monetary value. They are also a benchmark to measure reputation, growth and loyalty. These sales are a matter of survival for some.

Yoco is a payments organisation who empowers small businesses through tools and technology for payments, and as a result, have a vested interest in these businesses making more sales.

As a growing business, the teams within Yoco were starting to become more specialised and were focusing on smaller segments of the full customer journey. In order to maintain a focus on our customers' context and needs through this growth, we decided to conduct customer research. The goal of this initiative was to spark empathy and a shared understanding of our users.

My Role

I was part of the 3 women insights team who took on this research. The senior researcher in our team created the research framework, and we worked together on the execution. The project lasted 12 weeks.

The researcher role included:

• defining the objectives and approach

• gathering insights through semi-structured interviews

• synthesizing the insights into knowledge

• converting the knowledge into tools

• activating these tools and frameworks in the company

We travelled between Cape Town, Johannesburg and Durban. We interviewed between 21 and 30 merchants. We created 2 major tools and had multiple share-back sessions with the whole organisation.

Research locations

Solution

Through the research we were able to create a shared language and way of thinking when it comes to our customers. The output was presented and documented through workshops and tools.

The tools were flexible enough to be implemented by different teams into their current way of working and served as a good starting point for their processes. These tools also served as a foundation to build additional metrics to measure our performance against the KPI of total transactions value.

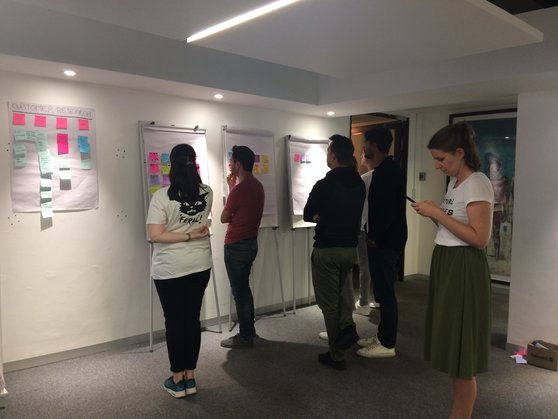

Empathy Workshops

We facilitated empathy workshops for groups of 10 - 20 participants at a time. Here we shared customer stories, the knowledge we had surfaced about their context and values, and tools that the teams can use. These sessions helped us activate our findings throughout the company.

Team Workshops

Individual teams wanted to get more specific feedback from our findings. Sales, customer support, product, design and marketing teams were interested in gaining insights more relevant to their areas. These team interactions varied in structure and length.

Activation Tools

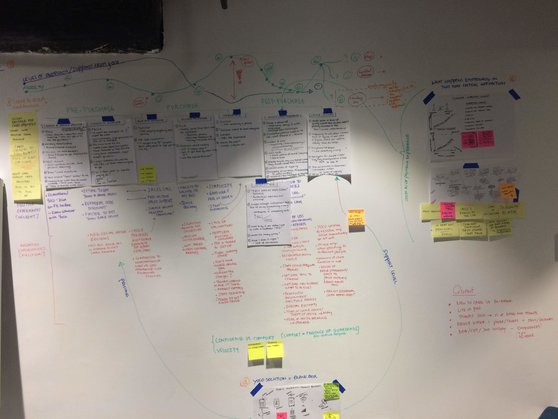

We wanted to make the synthesized information more concrete, so we built 2 customer journeys.

JOURNEY 1 : depicted the sentiment and anxiety levels when going through the purchasing process of a mobile card payment device.

JOURNEY 2: presented interactions and expectations of both the merchant and the customer during the value exchange (ie. purchase of products/services)

We created a deck of cards to present the research in an easy-to-consume format. The contents of the cards took a few iterations. We settled on presenting our customers’ lifestyle, behaviours and values. Each card also had a customer story on the back.

Included in the deck were a few key guiding principles that would help us when coming up with solutions for our customers, regardless of the team that is using them. These cards would provide a customer lens for teams to focus on. The principles were based on our findings from the field research and were informed by best practices that we had discovered during the desk research phase.

Approach

The key success metric for many large projects at Yoco was to track the amount of transactions that go through the system. This is a very clear indication of the merchants’ sales. The more sales that go through the systems, the better the merchants’ business is doing. We wanted to inform this metric with some qualitative data.

Crossing the chasm requires a change in strategy

As Yoco’s products become more popular, the customer base also shifts.This is true especially when we look at the market lifecycle stages. The organisation was crossing the chasm from early adopters to early majority. Innovators and early adopters are more tolerant and less risk averse than the early majority.

There were 4 phases of the project:

Definition

Framed the research question

Gathered internal knowledge

Desk research on best practices

Built research tools

Recruited participants

Research

Visited merchants in CPT, JHB and DBN

Conducted ethnographic interviews

Daily and weekly debrief sessions

Combining insights

Synthesis

Go into a state of panic

Surface insights and patterns

Validate insights where needed

Build tools and frameworks for sharing

Activation

Edit and review tools with stakeholders

Conduct empathy workshops

Share tools on digital repository

Evaluate research cycle

Definition

Framed the research question

Gathered internal knowledge

Desk research on best practices

Built research tools

Recruited participants

Research

Visited merchants in CPT, JHB and DBN

Conducted ethnographic interviews

Daily and weekly debrief sessions

Combining insights

Synthesis

Go into a state of panic

Surface insights and patterns

Validate insights where needed

Build tools and frameworks for sharing

Activation

Edit and review tools with stakeholders

Conduct empathy workshops

Share tools on digital repository

Evaluate research cycle

Learnings

1. Using a metaphor to compare our merchant relationship with our product helped deepen the conversation. We noticed that this made the customer comfortable and this in turn allowed us to uncover new insights.

2. Research is equal parts empathy, analysis, creativity and marketing. Having the conversation with a merchant is the most important part of the research, but we needed to ensure that the research was conducted with the relevant sample, and that the research had been effectively shared. We wanted the stories to be embedded into the knowledge base for product decision making. This required us to stretch into other complimentary areas.

3. Activation takes longer than you would expect. There were many nuanced insights that needed to be repositioned for designers to be able to use them for ideating solutions.